Reduce Unsecured Debt Without Borrowing More

Check Your Eligibility in Minutes

When Interest Keeps You Stuck

High-interest credit cards make it hard to get ahead.

Even steady payments can feel pointless when balances barely move. Late fees grow, and minimums rise. What starts as a short-term solution turns into long-term stress.

This programme is designed for individuals who are still earning but need a realistic way to reduce their outstanding debt, rather than simply moving it around or taking on another loan.

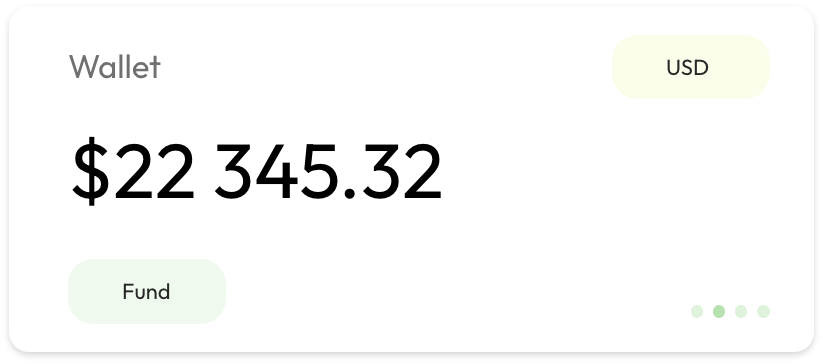

If unsecured debt is weighing you down, a savings check can show if part of your balance may be reduced by 20 to 50%.

How Debt Reduction Works

The process focuses on negotiation, not borrowing.

Instead of adding another payment, unsecured creditors are approached directly to reduce the outstanding balance based on financial hardship. If approved, debts are resolved for less than the original amount owed through a structured programme handled by a legal team.

The goal is simple: Lower balances, clear terms, and a realistic way forward.

You can start by seeing how much of your debt may be reduced before making any decisions.

What This Means for You

Clients choose this programme because it simplifies the situation. Here’s how:

One structured programme instead of juggling accounts.

Lower total balances instead of endless interest.

Clear timelines that help shorten the road ahead.

A single point of contact guiding the process.

For many, this means more control over monthly finances and a faster route out of unsecured debt.

Check your eligibility to see if this approach fits your situation.

© All Rights Reserved.